Every day, billions of dollars flow across cryptocurrency exchanges worldwide. Price differences between platforms can open short-lived chances for traders to buy low on one exchange and sell high on another. This process is called crypto arbitrage, and when done carefully, it can deliver steady profits even in volatile markets.

Understanding how to find crypto arbitrage opportunities can be the first step to building a solid trading strategy. Beginners often start by monitoring different exchanges, comparing fees, and checking withdrawal speeds. For a beginner-friendly approach to this concept, how to find crypto arbitrage opportunities offers a simple starting point. It shows how software can scan multiple platforms in seconds, saving traders time and reducing mistakes. Before using a tool, it helps to learn how manual spotting works.

Spotting Arbitrage Opportunities Manually

Manual monitoring of exchanges is like training your eyes before using a camera. You log into two or more exchanges, note the prices of the same coin, and calculate the difference. Even small gaps, such as $0.50 on a $30 token, can be profitable with enough volume. Yet, fees, transfer times, and liquidity can turn a profit into a loss if not accounted for.

Look beyond the numbers on the screen. Trading fees, withdrawal charges, and deposit delays must be factored into your calculations. Some exchanges process withdrawals instantly, while others take hours. By the time a transfer completes, the price gap may have closed. That’s why it’s crucial to test exchanges with small amounts before scaling up.

Creating a Personal Checklist

A checklist acts as your safety net when chasing arbitrage deals. It keeps you from forgetting vital steps and helps reduce risks. Here’s a simple beginner-friendly checklist:

- Compare prices: Track at least two or three exchanges for the same asset.

- Calculate net profit: Include trading, withdrawal, and deposit fees in your math.

- Check withdrawal speed: Test transfer times with small amounts first.

- Watch liquidity: Make sure there’s enough volume to execute your trade at the quoted price.

- Secure your accounts: Use two-factor authentication and strong passwords to protect your funds.

This checklist may feel simple, but it helps traders avoid costly errors. By practicing with small sums and reviewing your process, you learn how to react quickly without skipping critical steps.

How Scanners Automate the Process

Crypto arbitrage scanners work like radar systems for traders. They scan dozens of exchanges at once, highlight the best price gaps, and even calculate potential profits after fees. This saves hours of manual work. Some scanners allow you to set alerts, so you’re notified the moment a profitable gap appears. Automation does not remove risk entirely, but it speeds up your decision-making.

Tools can be powerful, but they are not a replacement for understanding the basics. By first learning manual spotting, you build the discipline to judge which opportunities are worth acting on. This discipline helps you avoid scams, poor liquidity, and sudden market reversals that can harm your balance.

Combining Knowledge with Technology

The smartest traders blend human judgment with machine speed. They use scanners to identify opportunities but rely on their own experience to decide whether to act. For example, a scanner may show a profitable gap, but you might know from practice that one exchange often delays withdrawals. You can then skip that trade, saving yourself a potential loss.

READ ALSO: Strategies that can Jumpstart Your Cryptocurrency Trading

Final Thoughts

Learning how to find crypto arbitrage opportunities takes patience, practice, and a balanced mindset. Start by spotting price gaps manually, build a checklist to reduce risks, and then explore scanners to automate your work. By combining careful observation with smart tools, you give yourself the best chance of finding profitable trades without unnecessary surprises.

As the market evolves, new tools and strategies will appear, but the basics remain the same. Understand the fees, test your exchanges, and keep security at the forefront of your plan. With discipline, even beginners can use arbitrage to turn small opportunities into consistent results.

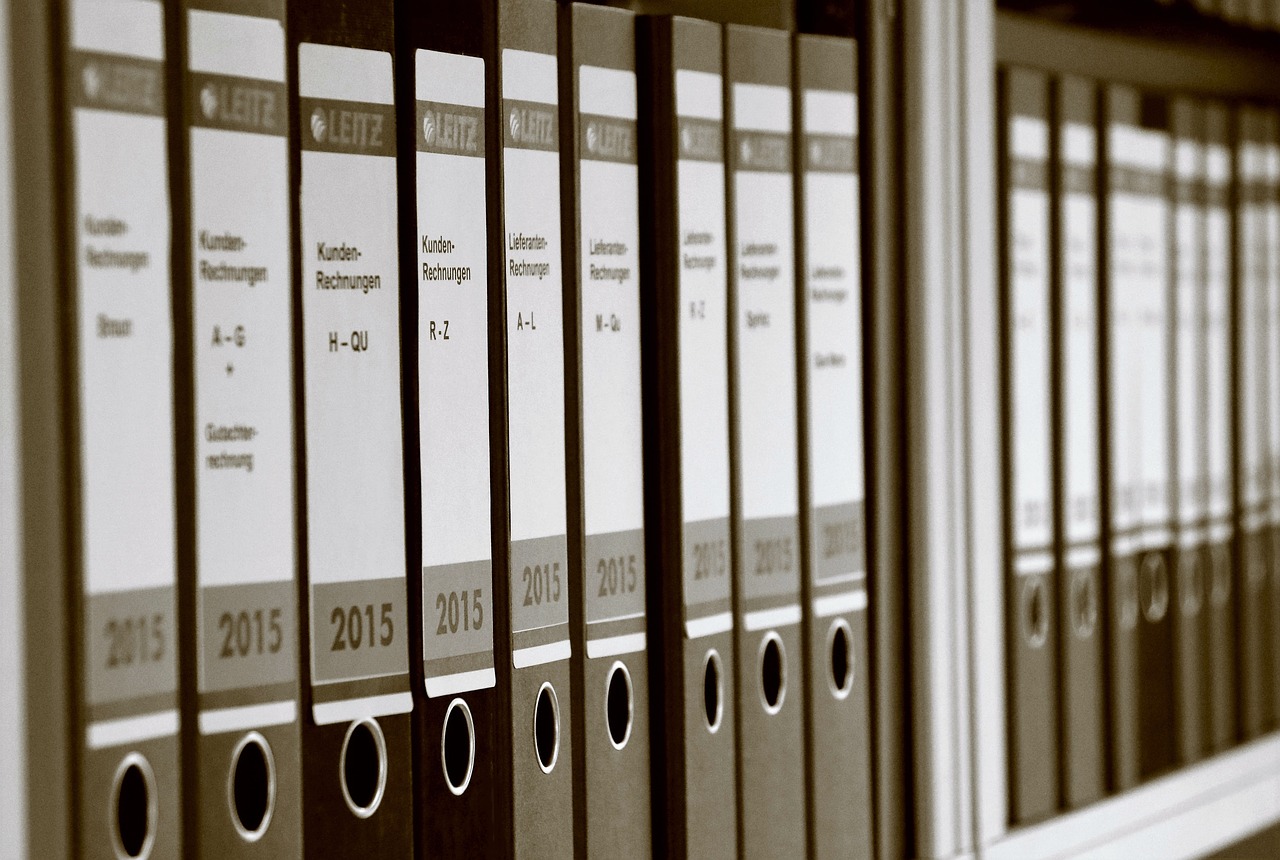

Open Banking is a financial technology innovation that enables banks to safely share the financial data of customers with the use of a third-party software called Application Programming Interface (API). The API provides the platform through which bank applications communicate to extract and share customer financial data. Doing so enables bank clients to access an extensive range of financial products and services; thereby providing them with more options in managing their financial resources.

Open Banking is a financial technology innovation that enables banks to safely share the financial data of customers with the use of a third-party software called Application Programming Interface (API). The API provides the platform through which bank applications communicate to extract and share customer financial data. Doing so enables bank clients to access an extensive range of financial products and services; thereby providing them with more options in managing their financial resources. Basically, open banking relies greatly on use of API technology, since it offers the interface within which a third-party software speaks to another third-party software. It’s important that an API is compliant with the rules and policies prescribed by banks, by the government and its regulatory authorities.

Basically, open banking relies greatly on use of API technology, since it offers the interface within which a third-party software speaks to another third-party software. It’s important that an API is compliant with the rules and policies prescribed by banks, by the government and its regulatory authorities.

In the past decades, the predatory lending practices of payday lenders have had detrimental effects on the lives and financial well being of wage earners. As a result, employees who rely on their payday checks are locked into predatory lending contracts, which in most cases affect their credit scores and personal lives. Fortunately, financial

In the past decades, the predatory lending practices of payday lenders have had detrimental effects on the lives and financial well being of wage earners. As a result, employees who rely on their payday checks are locked into predatory lending contracts, which in most cases affect their credit scores and personal lives. Fortunately, financial  Also known as On-Demand Pay, Earned Wage Access (EWA) software and mobile applications are payroll innovations that allow workers to take out salaries instead of predatory loans during the current payroll period but before the actual pay day. The EWA technology can also apply to hourly-wage earners by giving them access to accrued real-time wages already earned.

Also known as On-Demand Pay, Earned Wage Access (EWA) software and mobile applications are payroll innovations that allow workers to take out salaries instead of predatory loans during the current payroll period but before the actual pay day. The EWA technology can also apply to hourly-wage earners by giving them access to accrued real-time wages already earned. Today’s financial industry is being led by financial experts who based their improvement initiatives on past concerns and experiences of consumers. The improvements go beyond empowering bank customers to transact via their bank account but also by way of different payment processors so they can purchase various products and services

Today’s financial industry is being led by financial experts who based their improvement initiatives on past concerns and experiences of consumers. The improvements go beyond empowering bank customers to transact via their bank account but also by way of different payment processors so they can purchase various products and services  Automated processing of transactions is another great feature of AI supported banking. The AI’s machine learning ability relieves the account owner of repetitive actions, which reduces possibilities of errors, especially when indicating account numbers.

Automated processing of transactions is another great feature of AI supported banking. The AI’s machine learning ability relieves the account owner of repetitive actions, which reduces possibilities of errors, especially when indicating account numbers.

Early access to settlement money. it is important to understand that even if a settlement amount has been agreed upon, the processing of the check takes time.

Early access to settlement money. it is important to understand that even if a settlement amount has been agreed upon, the processing of the check takes time. This denotes that if the plaintiff took on a lawsuit loan, the lawsuit funding company will be able to collect the entire amount of pre settlement funding availed by the plaintiff. In addition, either a flat fee or interest charges will be imposed, depending on the terms and conditions to which the plaintiff and his lawyer agreed upon at the time when the lawsuit loan was granted.

This denotes that if the plaintiff took on a lawsuit loan, the lawsuit funding company will be able to collect the entire amount of pre settlement funding availed by the plaintiff. In addition, either a flat fee or interest charges will be imposed, depending on the terms and conditions to which the plaintiff and his lawyer agreed upon at the time when the lawsuit loan was granted. Cryptocurrencies have emerged as a dynamic and enticing investment option. As digital assets continue to gain prominence, mastering your finances becomes crucial for those looking to explore the world of crypto platforms such as

Cryptocurrencies have emerged as a dynamic and enticing investment option. As digital assets continue to gain prominence, mastering your finances becomes crucial for those looking to explore the world of crypto platforms such as

We are going to cover the most important things a real estate investor should consider when purchasing a property.

We are going to cover the most important things a real estate investor should consider when purchasing a property.