Singapore’s property market has long been a cornerstone of wealth creation, with residential projects in emerging districts offering some of the most promising opportunities. Tengah, envisioned as the nation’s first “Forest Town,” is one of the most ambitious urban developments in recent years. With its eco-friendly design, smart infrastructure, and strategic location near Jurong Innovation District, Tengah is quickly becoming a magnet for investors seeking long-term growth.

For those looking to enter this evolving market, securing a Tengah Garden Residences balance unit could be a strategic move. Balance units, which are unsold units released after initial sales phases, often provide investors with a chance to pick up prime properties at competitive prices. As Tengah continues to transform, these units represent more than just homes, they are potential assets for capital appreciation and rental yield.

Why Balance Units Are Attractive

Balance units are often overlooked, but they can be hidden gems. Developers release them after earlier sales rounds, meaning investors can still secure desirable layouts or views without paying inflated resale prices.

For Tengah Garden Residences, this is particularly significant because the project sits at the heart of Singapore’s newest eco-town. As demand grows, early investors who secure balance units stand to benefit from appreciation once the area matures. For anyone considering such opportunities, it helps to review important things to look for before buying a property to ensure decisions are aligned with long-term investment goals.

Another advantage is flexibility. Buyers can choose from available unit types that suit their investment goals, whether it’s a compact apartment for rental demand or a larger unit for long-term family living. This adaptability makes balance units appealing to both seasoned investors and first-time buyers.

Rental Yield Potential in Tengah

Rental demand is expected to rise sharply in Tengah due to its proximity to the Jurong Innovation District, a hub for advanced manufacturing and technology. Professionals working in the district will seek nearby housing, and Tengah Garden Residences offers modern living spaces with smart features that appeal to this demographic. For investors, this translates into strong rental yields and consistent tenant demand.

Additionally, Tengah’s connectivity enhances its rental appeal. With upcoming MRT stations on the Jurong Region Line and easy access to expressways, residents will enjoy seamless travel to other parts of Singapore. This accessibility makes Tengah Garden Residences a practical choice for tenants who want convenience without paying the premium of more established districts.

Capital Appreciation in a Growing Town

Tengah is still in its early stages of development, which means property values have significant room to grow. As infrastructure, amenities, and green spaces are completed, the town will become increasingly attractive to families and professionals. Investors who secure units now are positioning themselves ahead of this growth curve.

Capital appreciation is further supported by Singapore’s broader housing trends. With limited land supply and strong demand for sustainable living, projects like Tengah Garden Residences are expected to command higher resale values in the future. Early buyers who recognize this potential can lock in gains before prices climb.

Smart Eco-Town Advantage

Tengah is designed as a smart eco-town, integrating technology and sustainability into everyday living. Features such as centralized cooling systems, automated waste collection, and extensive cycling paths set it apart from traditional estates. These innovations not only enhance quality of life but also increase the long-term desirability of properties in the area.

For investors, this means owning a unit in a development that aligns with Singapore’s vision of sustainable urban living. As environmental consciousness grows, properties in eco-friendly towns are likely to see stronger demand compared to conventional estates.

Timing Matters

Investing early in Tengah Garden Residences is about more than securing a unit—it’s about positioning yourself for future growth. Balance units provide an entry point at a stage when prices are still competitive, yet the potential for appreciation is high. As Tengah evolves into a fully developed town, those who acted early will enjoy the rewards of foresight.

For investors weighing their options, the opportunity is clear. A balance unit in Tengah Garden Residences is not just a property purchase, it is a strategic investment in Singapore’s west, where growth and innovation are set to converge.

Conclusion

Singapore’s property market continues to evolve, and Tengah represents one of its most exciting frontiers. By securing a Tengah Garden Residences balance unit, investors gain access to rental yield potential, capital appreciation, and the prestige of owning property in the nation’s first Forest Town. With Jurong Innovation District driving demand and Tengah’s eco-town vision taking shape, the timing could not be better. For those seeking smart investments, balance units here may well be the key to long-term portfolio growth.

Open

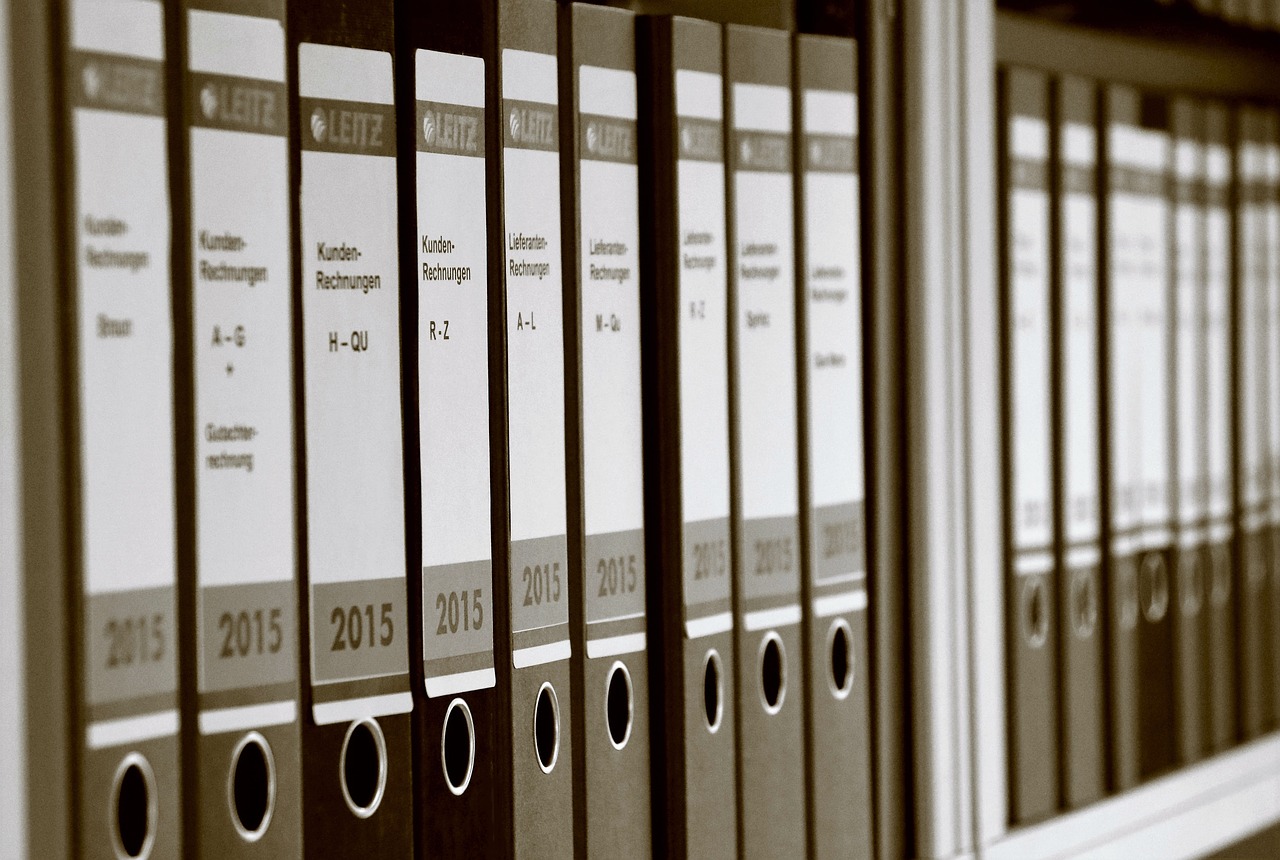

Open  Basically, open banking relies greatly on use of API technology, since it offers the interface within which a third-party software speaks to another third-party software. It’s important that an API is compliant with the rules and policies prescribed by banks, by the government and its regulatory authorities.

Basically, open banking relies greatly on use of API technology, since it offers the interface within which a third-party software speaks to another third-party software. It’s important that an API is compliant with the rules and policies prescribed by banks, by the government and its regulatory authorities. In the past decades, the predatory lending practices of payday lenders have had detrimental effects on the lives and financial well being of wage earners. As a result, employees who rely on their payday checks are locked into predatory lending contracts, which in most cases affect their credit scores and personal lives. Fortunately, financial

In the past decades, the predatory lending practices of payday lenders have had detrimental effects on the lives and financial well being of wage earners. As a result, employees who rely on their payday checks are locked into predatory lending contracts, which in most cases affect their credit scores and personal lives. Fortunately, financial  Also known as On-Demand Pay, Earned Wage Access (EWA) software and mobile applications are payroll innovations that allow workers to take out salaries instead of predatory loans during the current payroll period but before the actual pay day. The EWA technology can also apply to hourly-wage earners by giving them access to accrued real-time wages already earned.

Also known as On-Demand Pay, Earned Wage Access (EWA) software and mobile applications are payroll innovations that allow workers to take out salaries instead of predatory loans during the current payroll period but before the actual pay day. The EWA technology can also apply to hourly-wage earners by giving them access to accrued real-time wages already earned. Today’s financial industry is being led by financial experts who based their improvement initiatives on past concerns and experiences of consumers. The improvements go beyond empowering bank customers to transact via their bank account but also by way of different payment processors so they can purchase various products and services online. A retailer can offer different payment options to customers who do not use credit cards. In many cases when consumers are looking to make a

Today’s financial industry is being led by financial experts who based their improvement initiatives on past concerns and experiences of consumers. The improvements go beyond empowering bank customers to transact via their bank account but also by way of different payment processors so they can purchase various products and services online. A retailer can offer different payment options to customers who do not use credit cards. In many cases when consumers are looking to make a  Automated processing of transactions is another great feature of AI supported banking. The AI’s machine learning ability relieves the account owner of repetitive actions, which reduces possibilities of errors, especially when indicating account numbers.

Automated processing of transactions is another great feature of AI supported banking. The AI’s machine learning ability relieves the account owner of repetitive actions, which reduces possibilities of errors, especially when indicating account numbers.

Early access to settlement money. it is important to understand that even if a settlement amount has been agreed upon, the processing of the check takes time.

Early access to settlement money. it is important to understand that even if a settlement amount has been agreed upon, the processing of the check takes time. This denotes that if the plaintiff took on a lawsuit loan, the lawsuit funding company will be able to collect the entire amount of pre settlement funding availed by the plaintiff. In addition, either a flat fee or interest charges will be imposed, depending on the terms and conditions to which the plaintiff and his lawyer agreed upon at the time when the lawsuit loan was granted.

This denotes that if the plaintiff took on a lawsuit loan, the lawsuit funding company will be able to collect the entire amount of pre settlement funding availed by the plaintiff. In addition, either a flat fee or interest charges will be imposed, depending on the terms and conditions to which the plaintiff and his lawyer agreed upon at the time when the lawsuit loan was granted. Cryptocurrencies have emerged as a dynamic and enticing investment option. As digital assets continue to gain prominence, mastering your finances becomes crucial for those looking to explore the world of crypto platforms such as

Cryptocurrencies have emerged as a dynamic and enticing investment option. As digital assets continue to gain prominence, mastering your finances becomes crucial for those looking to explore the world of crypto platforms such as

We are going to cover the most important things a real estate investor should consider when purchasing a property.

We are going to cover the most important things a real estate investor should consider when purchasing a property.